12 Expected Family Contribution Tips

One of the biggest questions that parents with college-bound children puzzle with is if their child has a chance for financial aid.

The first step that you should take when grappling with this issue is to obtain your Expected Family Contribution (EFC). You should do this before seriously exploring your teenager’s college options.

This is more confusing than you might think because at some schools a family could qualify for need-based aid if they make $180,000 a year and at another school, the ceiling for aid could be $60,000 or lower.

12 Expected Family Contribution Tips

Here is a summary of what you should know about this important figure:

EFC Tip No.1:

An Expected Family Contribution is a dollar figure that represents what financial aid formulas believe a family should be able to pay for one year of a child’s college education.

EFC Tip No. 2:

The EFC for the average American household with an AGI of $50,000 will usually range from $2,000 to $3,000.

The lowest EFC is $0, which means the financial aid formula has determined that the household can’t afford to pay anything for college.There is no cap on EFCs so some very wealthy families will have EFCs that easily exceed the cost of an expensive private university.

EFC Tip No. 3:

It’s best to get a ballpark idea of what a family’s EFC will be as early as a child’s freshman year in high school. Obtaining a preliminary EFC will give parents a rough idea of the minimum amount that they would be expected to pay for college.

EFC Tip No. 4:

Families with household incomes of $70,000 to $80,000 and above typically find that they do not qualify for need-based aid at state universities, but they may qualify for need-based aid at private schools.

Determining if a student would be eligible for need-based aid requires subtracting the EFC from a school’s cost of attendance.

Example

$60,000 Cost of attendance – $25,000 EFC = $35,000 financial aid eligibility

In this example, the student would be eligible for up to $35,000 in need-based aid. Almost all schools would insert the federal Direct Loan in the package for a student. For most freshmen, the maximum would be $5,500. Unless a school meets 100% of financial need, it’s typically unlikely that the institution would provide grants to cover the rest of the gap.

EFC Tip No. 5:

Families, who discover that they have a high EFC and aren’t eligible for need-based financial aid, should look for schools that provide merit scholarships that are given regardless of need. It’s best not to get hung up about qualifying for need-based aid when most schools provide merit awards for affluent students.

If an EFC is modest, families should search for schools that provide excellent need-based assistance. Far fewer schools fit into this category. People who need financial help should also apply to their own public colleges.

EFC Tip No. 6:

Families will usually have to pay more for college than their EFC indicates they can afford because most schools do not meet 100% of a student’s demonstrated financial need. Consequently, it’s important to identify the most generous colleges that would consider a child an attractive candidate.

EFC Tip No. 7:

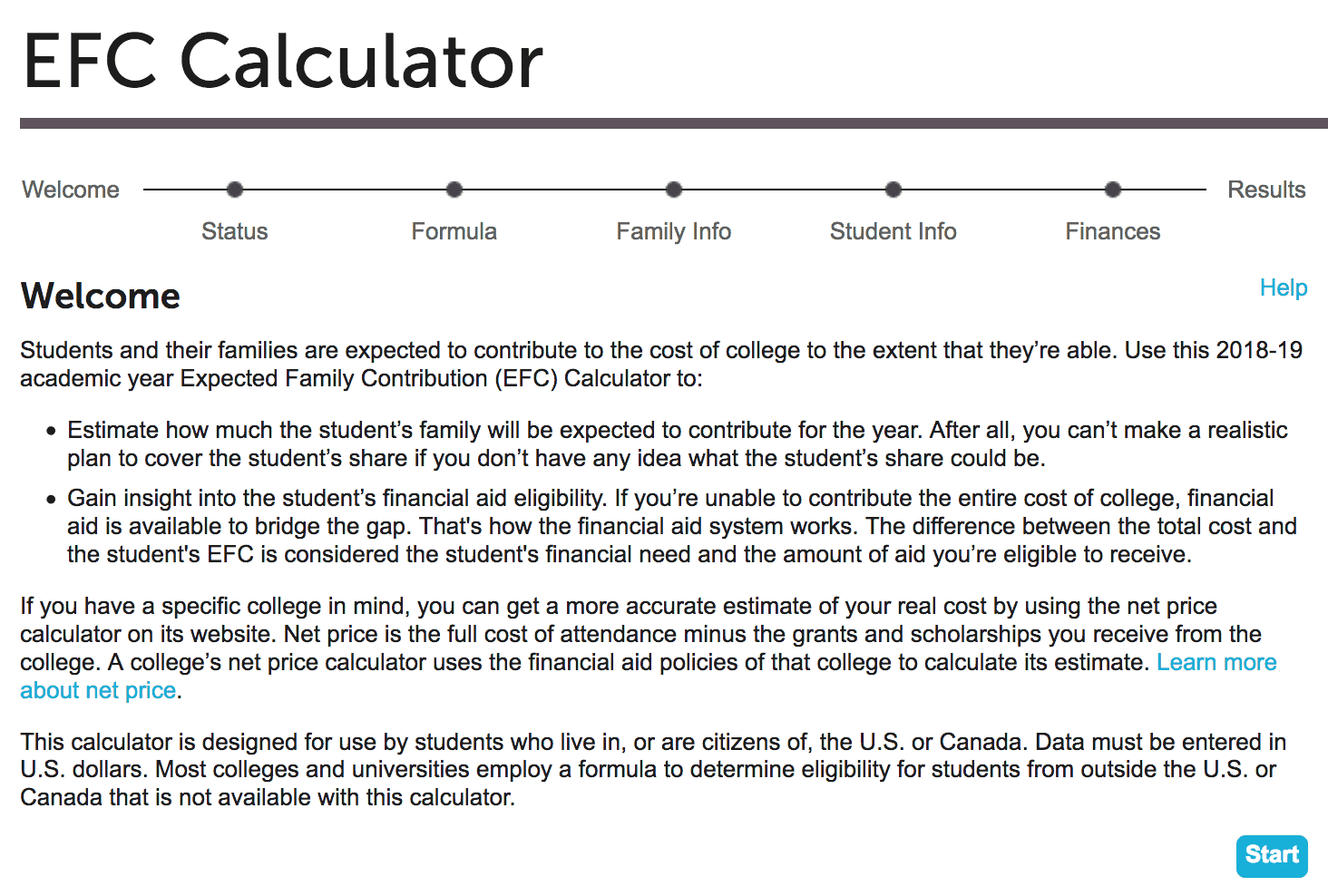

Parents can obtain their Expected Family Contribution by using the College Board’s EFC Calculator. Here is what the calculator home page looks like:

You will need to use figures from your income tax return and your latest non-retirement investment account statements including checking and savings accounts and any accounts and income that your child has.

With this calculator, parents will want to obtain their EFC using the federal and institutional formulas. The calculator will produce one EFC using the federal methodology that is linked to the Free Application for Federal Student Aid.

The calculator will also produce an EFC using the institutional methodology, which is linked to the CSS Profile. The vast majority of private and public colleges and universities only use the FAFSA while roughly 200 private, selective schools also use the Profile.

EFC Tip No. 8:

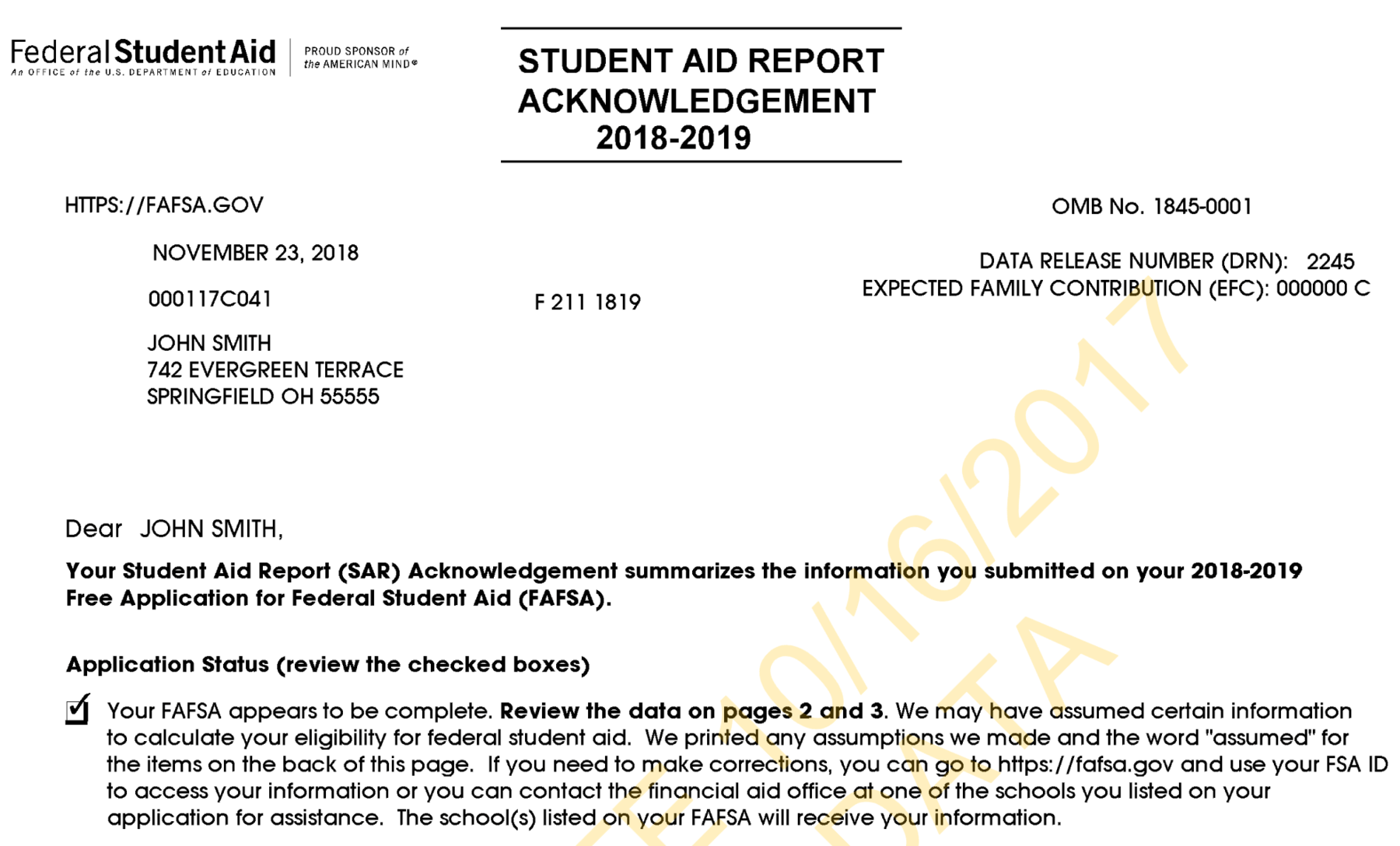

After completing the FAFSA, a student will receive his/her official federal EFC via an electronic document called the Student Aid Report. The SAR will include the family’s EFC near the top of the report and also provide all the information that the family included on the FAFSA. Parents should check for accuracy.

Strangely enough, the SAR does not put a dollar sign in front of a family’s EFC figure. In the example below, the family’s EFC is $0, but what you see is a string of zeros.

Here is a link to a sample SAR.

Here is a link to a sample SAR.

CSS Profile filers will not receive an EFC from the College Board, which owns and operates this financial aid application.

Institutions that use the Profile customize their aid applications by choosing from hundreds of different questions so you will end up with a different EFC for each school.

EFC Tip No. 9:

Parents should ask each Profile school for their EFC if the institutions do not include this important dollar figure on their children’s financial aid awards. Without knowing the EFC, the family won’t know if this is a good award.

EFC Tip No. 10:

Unfortunately, many schools don’t include a family’s EFC on their financial aid awards. Some institutions suggest that including the EFC on their aid letters will confuse families. More likely, schools don’t want to share EFC figures with families because they can then determine if the package is stingy.

Once a family has their EFC and the financial aid package, compare the EFC with what a school is offering.

Let’s say that the cost of a school after deducting institutional grants is $39,000 and the EFC is $28,000. That means there is an $11,000 gap between what the EFC suggests that a family can pay and what the school wants to charge your client. Based on this knowledge, a family can appeal the award.

Do not hesitate to appeal an underwhelming award. Many schools that need to hustle to fill their freshmen class every year will often be open to requests for more money. Of course, if your financial situation worsens, such as loss of a job or high medical bills, you should also appeal at any school.

EFC Tip

No. 11:

Plug new numbers into the EFC calculator if a family’s financial situation changes due to such things as a divorce, separation, death, disability, job loss or the care of an elderly parent.

EFC Tip No. 12:

For the 2023-2024 school year, the federal government will replace the EFC with the term Student Aid Index (SAI). Families will be filling this out begining Oct. 1, 2022.

The SAI will still be a dollar figure, but the formula the federal government uses will change. With the change, the PELL Grants, for low-income students, will have two different formulas based on Adjusted Gross Income and Poverty Line. The FAFSA confirmation page will immediately tell the student if they quality for a PELL Grant.

A big reason for the change is that the powers that believed that families felt bad when they couldn’t afford what the EFC said they could.

I suspect, however, that most people don’t even know that the term EFC exists, which is an indictment of the federal government, colleges and universities and high school counselors who fail to explain what the EFC is and why it’s so important. This isn’t going to change when the term is replaced with Student Aid Index.

Learn More…

If you’d like to dive much deeper into how to cut the cost of college, enroll today in my popular online course – The College Cost Lab.

Published at Tue, 25 May 2021 20:25:40 +0000

Article source: https://www.thecollegesolution.com/12-expected-family-contribution-tips/